A lot has been said about the multi-chain ecosystem. It's time we set the record straight.

Here are 5 comparison stats (2021 Vs. 2023) that highlight crypto's multi-chain reality and makes us believe that the time to go multi-chain is now.

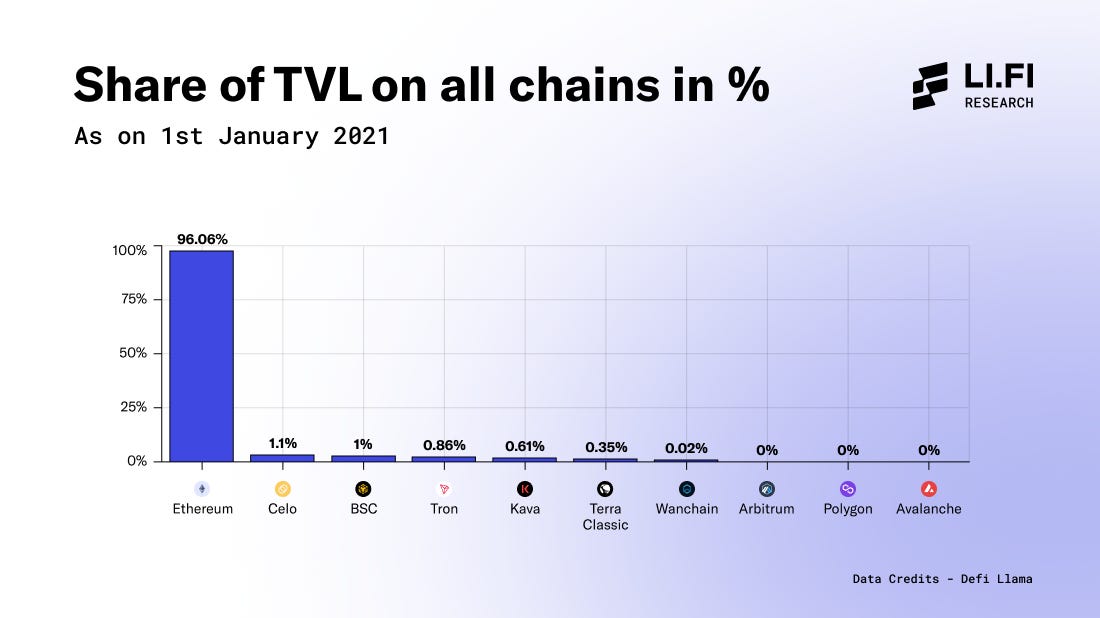

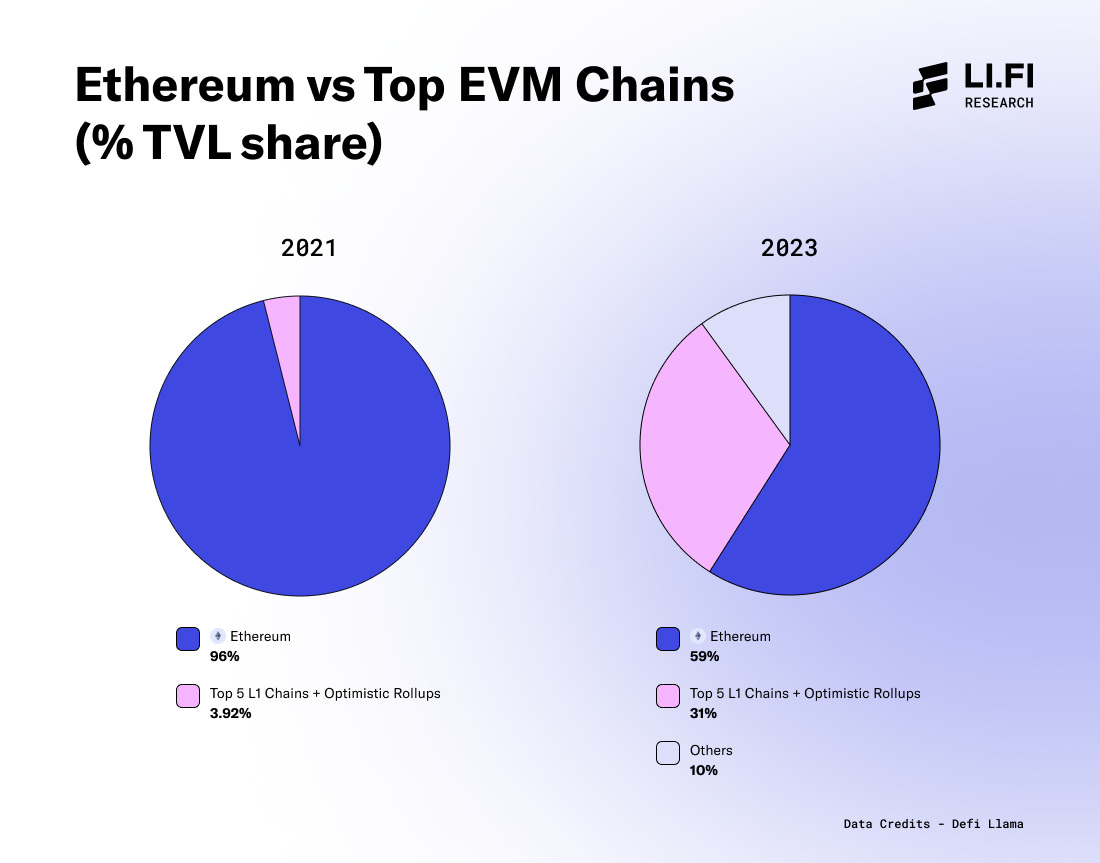

1. Ethereum dominance down from ~96% to ~59%.

Ethereum is still king but its TVL share fell from ~96% in 2021 to ~59% in March 2023.

(It went down below 50% for the first time in history on April 2, 2022, as Terra Classic’s ecosystem grew).

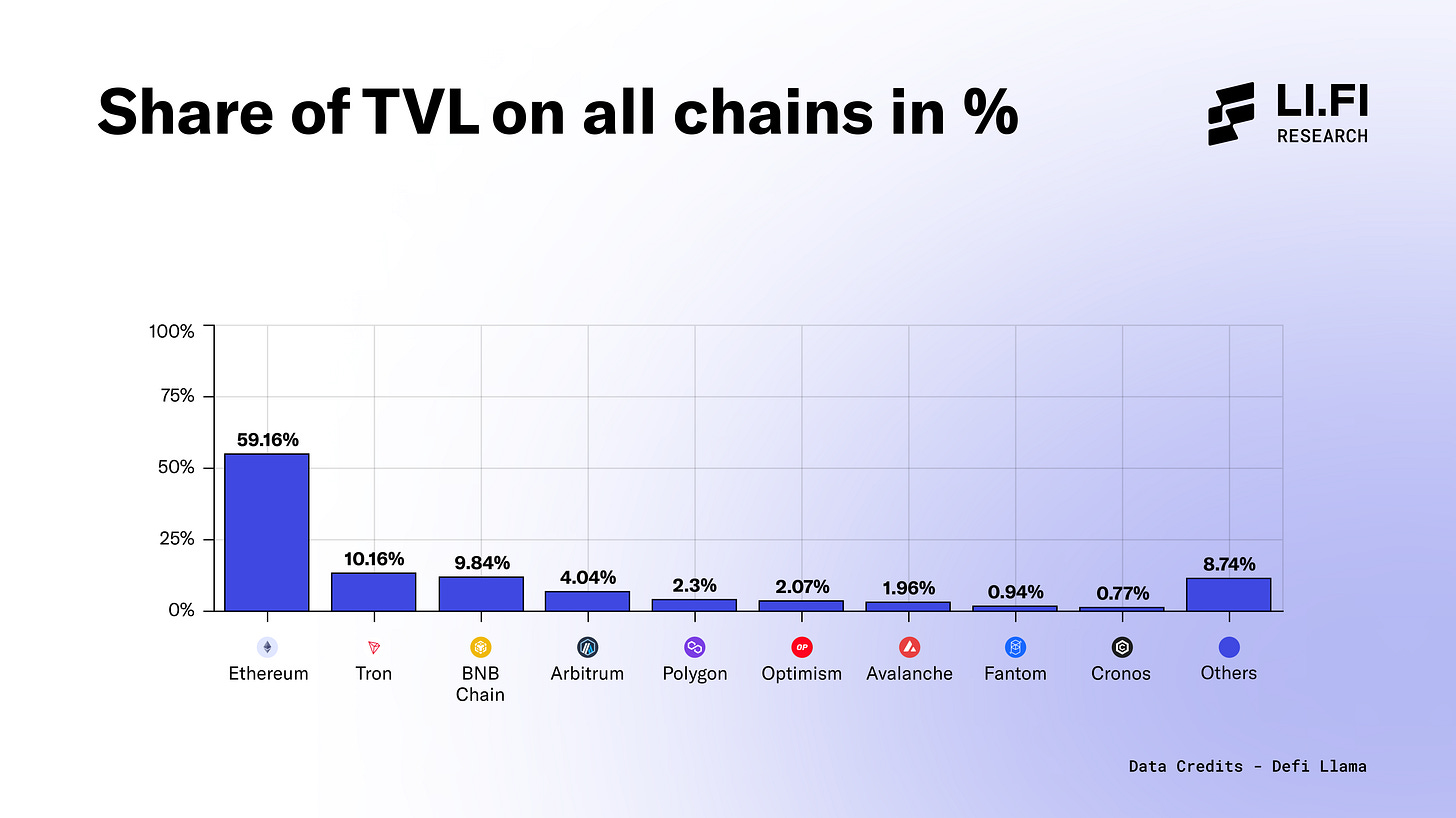

2. Growth of alt-L1 EVM-Chains (~25% TVL in DeFi)

Chains like Polygon, Avalanche, Fantom, Tron, and BNB Chain, among others, were virtually non-existent in 2021.

In 2023, these five chains alone attract nearly 25% of the TVL in DeFi.

3. L222 — Rollups were the story of 2022.

Rollups (blockchains that bundle transactions and settle on Ethereum) own approximately 6% of the TVL in DeFi.

Among rollups, @arbitrum (~69%) and @optimismFND (~29%) dominate.

Other rollups make up less than 2% of rollup TVL combined.

4. EVM chain Supremacy (~90% of all crypto TVL)

Ethereum, large L1 EVM chains, and rollups make up 90% of all TVL in crypto.

TVL on Solana, Cosmos chains, Bitcoin, Polkadot parachains, and Cardano contribute to the majority of the remaining TVL.

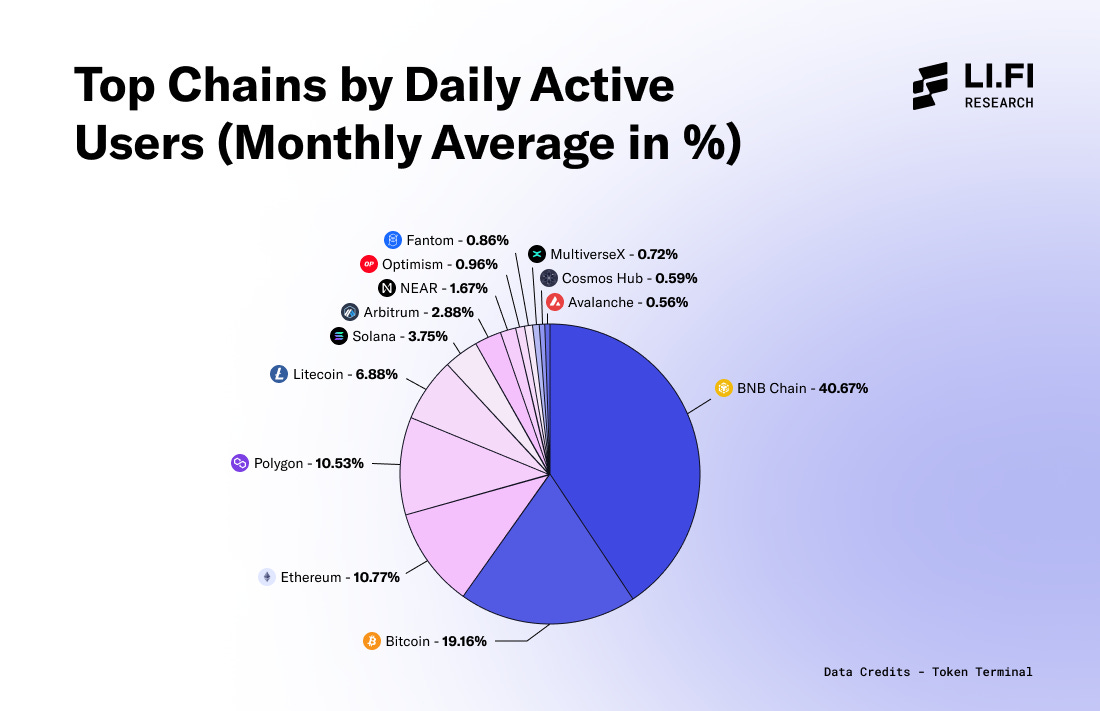

5. BNB Chain + Polygon = ~50% of daily active users in crypto.

Tx cost drives user behaviour and we’ve seen highly scalable chains like BNB Chain and Polygon dominate usage metrics like Daily Active Users.

Ethereum & Bitcoin are still widely used despite expensive and slow txs.

If you find this interesting, we’ve written an extensive article making the case to validate crypto’s multi-chain theses. Check it out!

Get Started With LI.FI Today

For more information about the LI.FI protocol,

Head to our link portal at link3.to/lifi

Read our SDK’ quick start’ at docs.li.fi

Join the official Discord server

Follow our Telegram Newsletter

Subscribe on our Substack

or try our any-2-any swaps NOW at jumper.exchange