Connext Amarok Live | Squid Router Launched | Avault Integrates LI.FI’s SDK | Uniswap Governance Discussions & More!

Last Week In The Multi-Chain Ecosystem (30 Jan - 05 Feb '23)

Welcome to LI.FI’s Cross Chain Insider newsletter. If you want to join this community of cross-chain aficionados learning about bridges, interoperability, and the multi-chain ecosystem, subscribe below:

You can also check out LI.FI’s research articles, and follow us on Twitter!

Bridge Updates

1) Connext Amarok is Now Live 👏

After 1 year of R&D, Connext’s Amarok upgrade is now live. According to the team, “Connext is the first Modular Execution Bridge, enabling trust-minimized communication between domains (chains & rollups) by optimistically relaying data between domains and falling back to the security of canonical bridges if something goes wrong.”

Users can now interact with Connext Amarok by:

Accessing the Bridge UI

Passively LPing for the ecosystem by depositing USDC & ETH

Running a router to become an active LP in the network.

Whereas dApp developers can permissionlessly build crosschain-native applications (xApps) on Connext.

2) Avault Integrates LI.FI’s SDK 🔥

Avault, a one-stop Omnichain yield platform, has integrated LI.FI’s SDK. Users can now seamlessly bridge and swap assets across 16 EVM-compatible chains and Layer-2s without having to leave the platform.

3) Threshold tBTC v2 (BTC Bridge to DeFi) is Now Live 💪🏻

Threshold, a decentralized threshold cryptography network (merger protocol of NuCypher & Keep Network), has launched tBTC bridge v2, enabling minting for decentralized, permissionless, scalable BTC bridge to DeFi. Users can now mint and bridge tBTC between Bitcoin and Ethereum.

Squid, an application for cross-chain swaps built on Axelar, is now live. Users can now swap any assets across 7 chains (Ethereum, Avalanche, Moonbeam, Polygon, Binance, Fantom, Celo) in a single click via Squid. Squid also announced its $3.5M seed funding round led by North Island Ventures.

5) Omnichain Lending & Borrowing on TapiocaDAO 🤌🏻

TapiocaDAO, an omni-chain money market, introduced lending and borrowing across 12+ chains powered by LayerZero’s message passing functionality.

6) Synthr Integrates LayerZero 🤝🏻

Synthr, a synthetic asset protocol, has integrated LayerZero to become an omni-chain infrastructure protocol. Synthr users can now access price exposure to non-native blockchain assets and liquidity from multiple chains.

7) Cross-Chain Transfers are Live on Layerswap 🚀

LayerSwap, a solution for bridging assets between CEXs and L2s, has introduced cross-chain transfers across 6 chains, including ImmutableX, Loopring, Starkness, BNB Chain, Optimism, and Arbitrum.

Multi-Chain Ecosystem Updates

1) Mars Hub Deployed on Osmosis 🔥

Mars Hub, a credit protocol previously building on Terra, is now live with adopting a unique hub and outpost model starting on Osmosis. Mars Hub users can now borrow and lend leading Cosmos tokens on Osmosis, with the fees collected going back to MARS stakers. Read more.

2) Ethereum Zhejiang Public Testnet Live 💪🏻

Ethereum Zhejiang, the first public tenet of Ethereum Shanghai, is live as of Feb 1st. The testnet version of Shanghai/Capella upgrade is scheduled to be implemented on Zhejiang at epoch 1350 (six days after the testnet genesis launch), enabling features including withdrawals on Zhejiang.

3) Optimism Bedrock Proposal 🧐

The Optimism Foundation has proposed the first protocol upgrade to the Optimism Collective: Bedrock. Bedrock will bring significant improvements to the Optimism network, including transaction costs, throughput characteristics, and sync speeds.

After just three weeks of launching the V10 upgrade, Evmos’ chain has now upgraded to V11. V11 lays the groundwork for liquidity staking derivatives (LSDs), Interchain Accounts, and other new features, improvements, and bug fixes on Evmos. Read more.

5) Acala is Now Supported by Wormhole 🚀

Acala, a Polkadot-based app-chain, announced the launch of the Wormhole bridge on Acala’s EVM+. Acala users can now access asset integrations and liquidity from Ethereum, BNB Chain, Polygon, and Solana.

What’s Popping on Twitter?

If you thought crypto was boring and uneventful, you’re clearly not aware of what’s happening in Uniswap’s Governance Forum. The Uniswap community is undergoing a vote that can arguably be one of the most important ones for the multi-chain ecosystem. Here’s all you need to know about this vote and the bridge wars that have unfolded because of it. Let’s dive in!

Where it all Started

On 11 December 2021, when ilia_0x, founder of 0xPlasma Labs drafted a proposal on the Uniswap Forum, suggesting to deploy Uniswap V3 on BNB Chain. According to ilia_0x, this was the right moment for Uniswap to deploy on BNB Chain for many reasons:

BNB Chain is one of the most prominent chains with a massive user base, a strong brand, unique features, and billions locked in its DeFi system, making it a no-brainer for Uniswap to expand to a potential new market.

Uniswap V3’s BUSL license will expire in April 2023, and to avoid any last-minute mistakes in deploying in a rush, it would make sense to start the process early.

PancakeSwap, a direct Uniswap V2 fork, currently dominates on BNB Chain with the most trading volume and utilization. By deploying Uniswap V3 on BNB Chain, Uniswap can eat up PancakeSwap’s market share and reduce the possibility + incentive for PancakeSwap to fork Uniswpa V3 when the license expires.

The logic behind this proposal was sound and welcomed by the Uniswap community. Everything sounds good, how do we move forward with this proposal?

As we’re all aware, such decisions for Uniswap are governed by the Uniswap DAO, which has approximately 370k token holders and 28k unique voters historically. Thus, even though everything sounds logical and in the best interest of Uniswap, one cannot simply execute a proposal on-chain so quickly. Before any Uniswap proposal is moved forward for on-chain governance, the following steps must be completed:

Proposal discussion on the Uniswap Forum — kicked off by ilia_0x on 11 Dec 2022.

Temperature check to assess the Uniswap community’s sentiment towards the proposal — Jan 16 to 21, 2023, a temperature check to deploy Uniswap V3 on BNB Chain using Celer’s cBridge goes live and is passed with 20M UNI Votes. However, this proposal did not move forward to the final governance and later, a temperature check was conducted between Jan 27 to 31, to decide which bridge Uniswap V3 should use for cross-chain governance message passing between Ethereum and BNB Chain, given that the proposal to deploy on BNB Chain passes.

Iterating the proposal based on the community feedback received during the temperature check.

The final on-chain vote for the proposal.

To say that these 4 steps had a lot of drama and complications would be an understatement. To understand what makes this proposal so controversial, let’s dig into the details of each of these steps.

Temperature Check — Which AMB should Uniswap V3 use for x-chain governance?

While the original temperature check regarding ‘Should Uniswap V3 be deployed to BNB Chain’ passed with 20M votes to “YES”, it was the temperature check to decide which AMB should be used for V3’s cross-chain messaging needs that caused a lot of drama. At this stage, it felt like the real bridge wars was unfolding in-front of us.

Originally per the initial proposal by 0xPlasma Labs, the team suggested using their message-passing solution, Hyperloop, for Uniswaps’ cross-chain governance needs. While Hyperloop is a viable solution for this case, as more community members, specifically other bridge builders, learned about the proposal, many alternative bridging solutions began to be proposed on the forum. The most notable ones that were later included in the temperature check included:

Additionally, while this was not part of the temperature check, an alternative multi-bridge implementation was also suggested, and it’s still believed that in the long term, instead of relying on a singling bridging solution, a multi-bridge solution could be the way to go (more on this later).

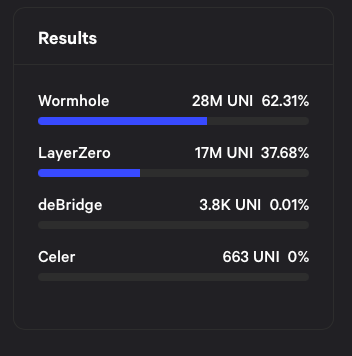

While there were 4 bridges in the running, it quickly became clear that the battle to be crowned Uniswaps’ go-to bridge provider would be coming down to Wormhole and LayerZero, at least for the sake of this temperature check.

Eventually, Wormhole came out on top in the temperature check with 28M UNI votes compared to LayerZero’s 17M. However, there’s one big detail that the screenshot below doesn’t convey.

a16z enters the forum

If you thought the role of governance in DeFi was a touchy topic, wait until you hear about the role a16z has to play in all of this.

While Wormhole was leading the temperature check, one big party behind the scenes was yet to make its move, and when it did, everyone stopped and took notice.

Eddy Lazzarin, an investing partner at a16z, took to the Uniswap Forum and conveyed that a16z was unable to participate in the temperature check due to certain technical issues. However, if they could vote, they would’ve voted their 15M UNI tokens towards LayerZero so “please count us this way”.

While this did not change anything at that time, it made the big picture clearer in the grand scheme of things — there’s a big roadblock in Wormhole’s road to being Uniswap’s go-to bridge solution in the form of a16z.

Now that we’re updated with everything that went down in what has turned out to be a major battle between key stakeholders of our ecosystems (bridges, community members, and most importantly, VCs), let’s take a look at where we stand today.

Present day — Is there a winner after all?

At the moment, there’s a final governance vote being conducted in accordance with the recent temperature check. As per this proposal, Uniswap V3 will be deployed on BNB Chain with Wormhole as the selected bridge and community members can vote for or against it. And as expected and stated by a16z earlier, they have used their 15M UNI tokens to vote against this proposal.

While this has reignited the debate around Uniswap’s governance and the role of governance tokens in DeFi, things might not be as bad as everyone expected earlier. Initially, the consensus was that a16z would single-handedly swing the vote against Wormhole with their 15M UNI tokens, but as things stand currently, the community seems to be rallying to push this proposal to deployment.

This is believed to be because of the following reasons:

Irrespective of the selected bridging solution, it’s vital to deploy Uniswap V3 on BNB Chain as early as possible, given the time constraints due to the license expiration in early April.

Any bridging solution chosen for the moment (in this case, Wormhole) is only temporary until a multi-bridge implementation is worked out using the cross-chain assessment process outlined by Devin Walsh.

It’s still unclear how Uniswap will move forward with its plans to deploy on BNB Chain (and others) and how cross-chain governance will work out eventually. But the fact that everyone in the ecosystem is debating DeFi governance and bridge security must be seen as a big win for all of us.

We hope that a productive solution that helps the ecosystem grow and move in the right direction can come out from these discussions, and we look forward to how this story develops in the near future.

Interesting Reads

1) On LayerZero’s Security

James Prestwich: disclosing two critical trusted-party vulnerabilities in the LayerZero smart contracts

Bryan Pallegrino’s response and LayerZero’s first principles

TL;DR and easy explanation on the LayerZero Discussion

2) Philipp Zentner on LI.FI Winning >90% Volume on MetaMask Bridges

3) Breaking Down Bridges into a Modular Framework

4) Axelar on What Is a Cross-Chain Swap?

Get Started with LI.FI Today

To learn more about us,

Head to our link portal at Link3.to/lifi

Read our SDK ‘quick start’ at docs.li.fi

Join the official Discord server

Follow our Telegram Newsletter

or try our any-2-any swaps NOW at transferto.xyz

nice project

Very good project