ConsenSys' Linea Alpha | Axelar x Microsoft | Celo Proposal to Become an Ethereum L2 & More!

Last Week In The Multi-Chain Ecosystem (10 - 16 July '23)

Welcome to LI.FI’s Cross Chain Insider newsletter. If you want to join this community of cross-chain aficionados learning about bridges, interoperability, and the multi-chain ecosystem, subscribe below.

You can also check out LI.FI’s research articles, and follow us on Twitter!

Bridge Updates

1) Update on the Multichain Debacle ⚠️

Last week, Chainalysis reported that the exploit "appears to be a hack or rug pull by insiders." The funds were suspiciously moved to an unknown address, leading to rumors on Twitter that Multichain was hacked by the team itself. Multichain's statement on Twitter later confirmed these rumors.

According to Multichain’s announcement, “On July 9, Zhaojun's sister transferred the remaining user assets in the router pool and subsequently notified the team and several project parties of this asset preservation action.”

The Multichain team lost access to the MPC servers crucial to the functioning of the system after the CEO Zhaojun’s arrest as the bridge’s network of MPC nodes were controlled by the CEO and were running on his personal cloud server account.

The consequences of these events have been far-reaching, impacting many users, LPs, projects, and ecosystems like Fantom, forcing them to seek alternatives to Multichain’s assets and bridging services.

2) Axelar x Microsoft 🤝

Axelar announced a partnership with Microsoft focused on enhancing the integration between Web3 and traditional internet systems. As part of this initiative, Axelar's interoperability solution will be made accessible to Microsoft's extensive customer base through the Azure cloud marketplace.

Fuji Finance, an auto-refinancing lending protocol, launched V2, known as Himalaya, the first cross-chain money market aggregator. With Fuji V2, users can deposit, borrow, repay, and withdraw a position from any supported chains (Polygon, Optimism, Arbitrum, and Gnosis).

4) Parallel Partners with LayerZero 🫡

Parallel, a Sci-Fi world and Card Game, announced its partnership with LayerZero to launch ‘the Portal’ for moving its $PRIME token between Base and Ethereum.

5) Caddi Finance, Copiosa Wallet & Qrolli Integrate LI.FI 🦎

LI.FI announced several integrations in the past week, including:

Caddi Finance, a browser extension tool that helps users find the best swap prices in crypto, has integrated LI.FI to enable its users to execute trades across Ethereum, Arbitrum, and Polygon.

Copiosa Wallet, non-custodial web3 wallet, is using LI.FI to help power bridging and swapping of 700+ assets inside its app.

Qrolli, a new Web3 social media platform that empowers users to own their content, has integrated LI.FI’s Widget.

Multi-Chain Ecosystem Updates

1) ConsenSys' Linea Mainnet Alpha Release 💪

Linea announced its Mainnet alpha release, introducing upgrades such as “a new outer-proof system and batch conflation, plus a dynamic fee mechanism to manage changes in L1 gas fees.”

The alpha release comes after a successful public testnet and Linea has started onboarding launch partners.

Polygon released it’s technical proposal of Polygon 2.0, proposing an upgraded token for the protocol called POL.

POL is a proposed technical upgrade of MATIC and will be the native token of the Polygon ecosystem that allows holders to become validators across multiple Polygon Supernets to receive fees and rewards.

3) StarkNet Mainnet Quantum Leap 0.12.0 is Live 🔥

Starknet launched the v0.12 upgrade to its mainnet. This upgrade showcases an increased throughput of 10x and marks the beginning of the highly anticipated Quant Leap upgrade, which promises enhanced performance and scalability.

4) Celo Proposal to Become an Ethereum L2 🧐

cLabs posted a proposal on the Celo forum “for Celo to return home to Ethereum by transitioning from being an independent EVM-compatible Layer 1 blockchain to an Ethereum Layer 2.”

The move aims to leverage OP Stack to become an Ethereum L2 and outlines critical elements of the transition, including:

Decentralized sequencer powered by Celo’s existing validator set.

Off-chain data availability layer, powered by EigenLayer and EigenDA.

A design that retains Celo’s 1-block finality.

5) Base Mainnet is Open for Builders 🫡

Base mainnet is now open for builders. This first phase of mainnet enables builders to deploy their products onto Base before the chain is open for users in early August.

What’s Popping?

Today’s “What’s Popping?” is an analysis of cross-chain swaps across LI.FI by Douglas Fir.

A few months ago, Douglas created a Dune Dashboard on LI.FI which offers valuable adoption metrics, including integrator and bridge-related data like transactions and volume. Additionally, it provides insights into user behavior and highlights the most popular assets that have been bridged.

Douglas summarizes his learnings in this post, and we are excited to share them with you. We hope you enjoy reading it as much as we did.

Note: the presented data does not provide a complete overview of LI.FI’s metrics. Currently, LI.FI operates on 17 blockchains, but the dashboard only covers transactions across 8 of them. Moreover, Dune lacks the price data for each wrapped asset, which is sourced from coinpaprika resulting in minor price discrepancies. Lastly, it’s important to point out that the data in the dashboard is sourced from late May 2022 while LI.FI has been live since December 2021.

With these considerations in mind, let’s dive in!

— — —

Exploring LI.FI: Revealing Trends and Patterns in Cross-Chain Transactions

1. Aggregate Stats

In the past year, LI.FI has successfully processed over 1.1M transactions with a combined value exceeding $1B. The LI.FI protocol has attracted more than 380,000 users, showcasing its growing popularity.

Notably, in November 2022, the monthly transaction volume surpassed $100M for the first time. In March 2023, the volume surged even further, surpassing $150M. However, April 2023 proved to be the most bustling month for LI.FI, with volume exceeding $200M. During this month, the number of transactions surpassed 200,000.

This notable surge in volume can be attributed, at least in part, to users eagerly participating in airdrops from L2s, such as the $ARB airdrop in March.

2. User Activity

Among the 380,000 users, there is one address that stands out as the most active. This wallet has bridged almost $10M with LI.FI, marking the highest volume achieved by a single address. Notably, this user conducted all their transactions through Jumper.exchange, the cross-chain exchange developed by LI.FI. It is worth mentioning that most of the volume was bridged from Arbitrum to Ethereum, as depicted in Figure 1.

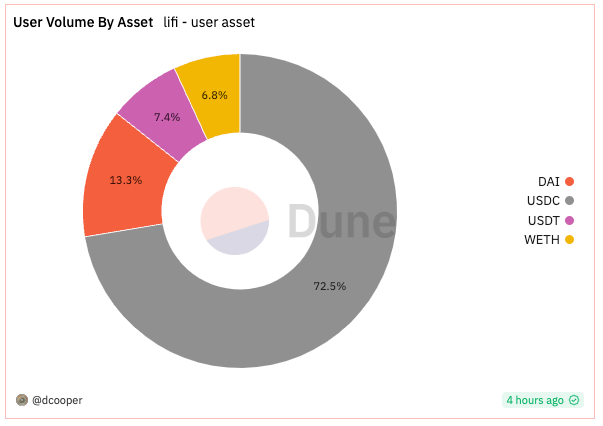

In terms of the assets that were bridged, stablecoins such as USDC, DAI, and USDT, along with WETH, played a significant role, as shown in Figure 2. Approximately 75% of the total volume consisted of USDC. Surprisingly, this was done in only 24 transactions.

Interestingly, the address with the second-highest volume only conducted a single transaction, bridging $8 million from Optimism to Ethereum.

But which address executed the most transactions? This address bridged over 900 times from Polygon to Arbitrum for only $14k!.

If we consider the top-10 addresses, the ones with the highest volume are on Ethereum and L2s such as Arbitrum and Optimism. On the other hand, addresses with a high transaction count are typically on Polygon, BNB and other L1s.

3. Integration Partners

LI.FI has gained significant adoption, with over 100 applications integrating it for cross-chain functionality. Let's delve into some of the most popular ones.

As depicted in Figure 3, Jumper Exchange (formerly known as transferto.xyz) stands out as the primary contributor to the overall volume.

Additionally, Figure 4 showcases the monthly transaction numbers, further highlighting Jumper's dominance.

Notably, between December 2022 and April 2023, there was a influx of volume originating from MetaMask. According to the Dune Dashboard shared by @Marcov, during the initial months of 2023, more than 90% of all MetaMask bridge transactions were routed through LI.FI.

4. Bridges

LI.FI uses a meticulous selection process to determine the most suitable bridge for users, considering their specific requirements while ensuring best price.

So, which bridge is most frequently utilized?

Historically, bridges like Multichain and cBridge have been called upon to offer low-cost and quick transactions. However, this trend is changing, with bridges like Stargate and Across now dominating volumes. In June, Stargate facilitated nearly 30% of the total volume, whereas Across accounted for ~15%.

5. Chains and Ecosystems

The majority of the volume within the LI.FI ecosystem is primarily bridged between Arbitrum, Optimism, and Ethereum, as illustrated in Figure 6.

Notably, a substantial sum exceeding $130 million has been successfully bridged from Arbitrum to Ethereum, making it the most popular route in terms of volume. Following closely, asset transfers from Optimism to Arbitrum accounted for the second-highest volume, totaling $108 million.

When it comes to the number of transactions, the Arbitrum to Optimism route is the busiest, seeing almost 140k transactions.

6. Assets

When it comes to the assets that are bridged, there are not many surprises. As one would expect, the majority of the volume (95%) is from bridging USDC ($530M), ETH ($265M) and USDT ($180M). These are also the tokens that usually have the highest daily trading volume.

In addition to bridging assets to different chains, LI.FI also allows for swapping assets (e.g. from WETH to DAI). Figure 7 shows that since the second quarter of 2023, the proportion of transactions that include an asset swap has risen notably. In fact, about half of all bridge transactions in June included an asset swap!

Get Started With LI.FI Today

For more information about the LI.FI protocol,

Head to our link portal at link3.to/lifi

Read our SDK’ quick start’ at docs.li.fi

Join the official Discord server

Follow our Telegram Newsletter

Subscribe on our Substack

or try our any-2-any swaps NOW at jumper.exchange

Interesting Reads

1) Cross-chain communication exploration – rollups’ vision

2) How LI.FI manages 300+ smart contracts on 25+ EVM chains

3) Infrastructure Abstraction: The LI.FI Vision