It should feel counterintuitive to launch a token on a single chain. And yet, that’s exactly what most teams still do.

In crypto, we’re sitting on the most composable capital markets infrastructure the world has ever seen. Tokens, arguably the most native primitive of this ecosystem, are still being launched with the same distribution strategy as a Silicon Valley startup. Launch on a single chain and call it a day.

This is just inefficient. Launching a token on just one chain is like listing a stock only on one stock exchange. Sure, it's technically listed. But you’ve opted into a tiny sliver of the global financial surface area.

So why do people do it?

In the world of traditional finance, there's a reason: regulation, jurisdiction, and legacy market structures. Stocks IPO in New York Stock Exchange or Bombay Stock Exchange because those cities are home to the institutions, the laws, the regulatory infrastructure that make it possible. Geography matters. Jurisdiction matters.

But crypto has no such restrictions. Chains aren't countries. They're markets. They’re a trading venue, a liquidity zone, a pool of speculators, protocols, and users with their own behavioral norms.

A token launched on Ethereum has no reason not to be traded on Solana, Avalanche, Optimism, or wherever else the liquidity wants to go. The infrastructure is here. The interop rails exist. Capital wants to flow. The only thing standing in its way is ironically the teams launching the tokens.

To be clear, this isn’t a failure of infrastructure. It’s a failure of imagination.

The technology exists to launch tokens across chains from day one. Teams simply haven’t figured out how to turn that into a go-to-market advantage. Instead of embracing multi-chain distribution as a feature, they treat it as a problem to solve later. Or worse, they don’t think about it at all.

That’s partially because most token launches today are low-quality. Memecoins don’t care about distribution strategy. They don’t care about building economic foundations or reaching new user segments. They’ll go where the degens are, launch where the trench warriors live, and move on when the liquidity dries up (Hyperliquid). And that’s fine, for them. But high-quality projects shouldn’t be copying this playbook. They should be pioneering a new one.

We’ve already seen hints of what that playbook could look like. Stablecoins, interestingly, have been the first real category to take multi-chain distribution seriously.

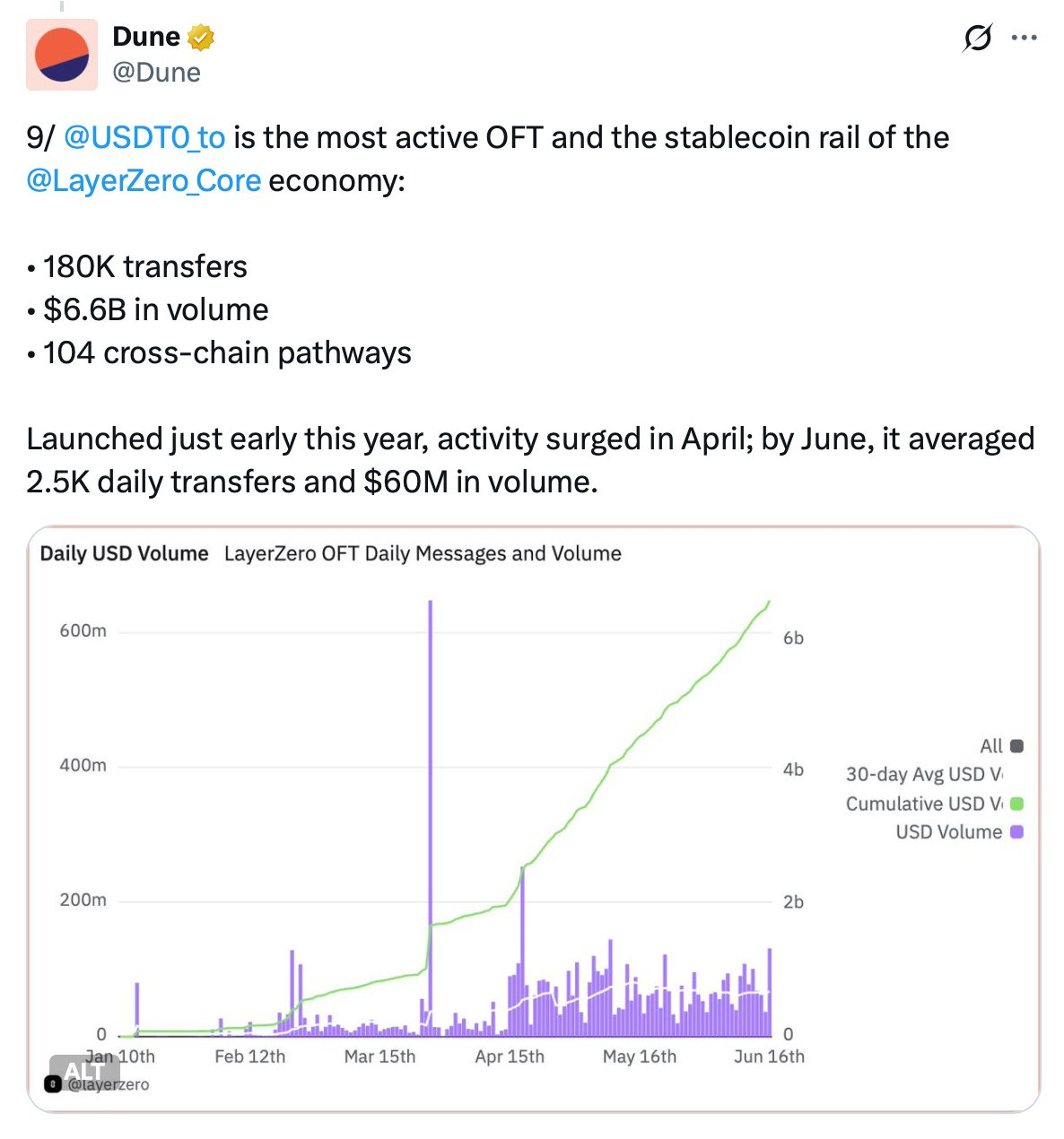

Most recently USDT0’s launch treated each chain as a distinct economy worth penetrating. Collateral use cases, different integrations, different liquidity partnerships. Each chain becomes a market in the truest sense.

The USDT0 launch is arguably the most well executed distribution strategy we’ve seen in 2025. It’s a case study in how to use interop as a concrete growth strategy to unlock new chains (read new markets).

USDT0 didn’t try to build interop infra themselves, they outsourced it to LayerZero. Then they focused on the one thing that mattered: distribution — becoming the native USDT token on chains, being used as collateral in DeFi, gas token on new stablecoin chains like Stable, becoming the trading pair on CEXs, offering mint and burn rebalancing for market makers, slippage-free mobility of liquidity with OFTs.

In short: USDT0 used the interop infrastructure and nailed distribution.

Of course, it helps that USDT0 stands on the shoulders of USDT. They have brand trust, liquidity, and network effects. But that doesn’t make their strategy less relevant. If anything, it proves the point: when teams actually care about distribution, the tech is ready. The market is ready. What’s missing is the willingness to break from the old script.

The next wave of high-quality token launches won’t think of themselves as launching “on Ethereum” or “on Solana.” They’ll think of themselves as launching into crypto. Full stop.

And when that happens, launching on a single chain will look like what they really are: a missed opportunity to make the most of what crypto has to offer.

The strange thing is, this isn’t some futuristic idea. Crypto is already unmistakably multi-chain, and in a fragmented ecosystem like this, interop rails are the only way to reach the full market. The reason more teams haven’t caught on is because they’re still following a token launch playbook written for a different era, when the world was simpler and single-chain strategies could still work. Eventually, people will realize the old rules no longer apply, and that success in crypto now depends on writing new ones.

For more information about LI.FI,

Head to our link portal at link3.to/lifi

Read our SDK’ quick start’ at docs.li.fi

Follow our Telegram Newsletter

PS: We’re hiring for multiple roles at LI.FI. Check them out and apply now.