LayerZero $15M Bug Bounty | Wormhole $50M Ecosystem Fund | The Future of Cross-Chain Wallets & More!

Last Week In The Multi-Chain Ecosystem (15 - 21 May '23)

Welcome to LI.FI’s Cross Chain Insider newsletter. If you want to join this community of cross-chain aficionados learning about bridges, interoperability, and the multi-chain ecosystem, subscribe below.

You can also check out LI.FI’s research articles, and follow us on Twitter!

Bridge Updates

1) LayerZero $15M Bug Bounty 🔥

LayerZero announced the launch of its $15M bug bounty on Immunefi, 50% larger than any bug bounty in history.

2) Wormhole $50M Cross-Chain Ecosystem Fund 💪

Wormhole introduces a $50M cross-chain ecosystem fund with the goal ‘to onboard the next generation of Web3 applications that create experiences users love’. The ecosystem fund seeks to support the teams building on Wormhole’s messaging protocol in their development and go-to-market.

3) Crown World Partners with LI.FI 🤝

Crown World, the hub for crypto investors that offers wide-ranging products like a launchpad, NFT marketplace, and bounty platform, has integrated LI.FI’s widget to bring advanced bridge aggregation and DEX connectivity to its users.

4) Balancer Cross-Chain Boosts Powered by LayerZero 🔗

Balancer, an AMM protocols built on Ethereum, has introduced Cross-Chain boosts powered by LayerZero, enabling users to sync their $veBAL positions and take advantage of $BAL Boosts on L2s.

5) Connext Ecosystem Portal is Now Live 🧐

Connext has launched an ecosystem portal, a one-stop resource for the broad community to explore the range of xApps building on top of it.

Multi-Chain Ecosystem Updates

1) Cosmos Mesh Security Initiative 👏

The Osmosis Grants Program, in partnership with Axelar, Akash Network, the Osmosis Foundation, and the ATOM Accelerator, is funding an initiative to complete the development of Mesh Security and bring it to mainnet across the Cosmos ecosystem.

Mesh Security’s primary use case is to provide additional economic security to appchains that have already established their stakeholder sets and have a sufficiently high market cap to secure themselves.

2) x48 Introduces Multi-Chain Contract Diff Tool 🫡

x48, previously a core dev at Yearn, has introduced Contract Diff Tool — a tool for comparing contracts across many chains. Some notable features of the tool include:

Multi-chain support for ~300 chains

Multi-file contracts support

Auto formatting of contracts using prettier

Split or unified mode

3) Compound V3 Live on Arbitrum ⛓️

Compound III is now live on Arbitrum — users can now use ARB, GMX, WETH, and WBTC as collateral to borrow USDC on Arbitrum.

4) Concrete — Framework for Building Rollups on OP Stack 🔥

Concrete is a framework to build application-specific, EVM-compatible rollups on the OP Stack.

It exposes an API for application-specific logic to interact with chains and handles the low-level complexity enabling the development of general-purpose EVM rollups optimized at the protocol level to better support a specific use case.

5) Mina Protocol Incentivized Testnet 🧐

Mina Protocol announced its incentivized tenet — Testworld Mission 2.0, an opportunity for validators, zkApp developers, and users to test the Mina blockchain ahead of its upcoming Hard Fork.

What’s Popping?

TLDR of ‘The Future of Cross-Chain Wallets’ Research by Blockchain at Berkeley

In an interesting collaboration with LayerZero, the consulting department of Blockchain at Berkeley embarked on a journey to explore the promising realm of cross-chain wallets. Their efforts culminated in a comprehensive report that offers valuable insights and recommendations for the future development of cross-chain wallets.

Today, we will dive deep into this report and provide a concise yet informative summary of its key findings while supplementing it with our unique perspectives and observations.

Let’s get started!

The Problem w/ Existing Cross-Chain Wallets

The report presents a compelling core thesis that wallet providers must optimize their cross-chain products in terms of features and user experience (UX) to thrive in the multi-chain landscape and meet the needs of future crypto users.

The team discovered that existing wallets require users to navigate through an excessive number of steps to interact with different blockchains, including:

Finding a bridge

Going to the bridge’s website

Logging in with their wallet

Using the bridge to bridge the assets to the desired chain

Waiting for the transaction to execute

To improve user experience, it is essential to streamline the bridging process, allowing users to interact with different chains seamlessly. By abstracting this process, users can save time, reduce the risk of errors, and overcome barriers to entry.

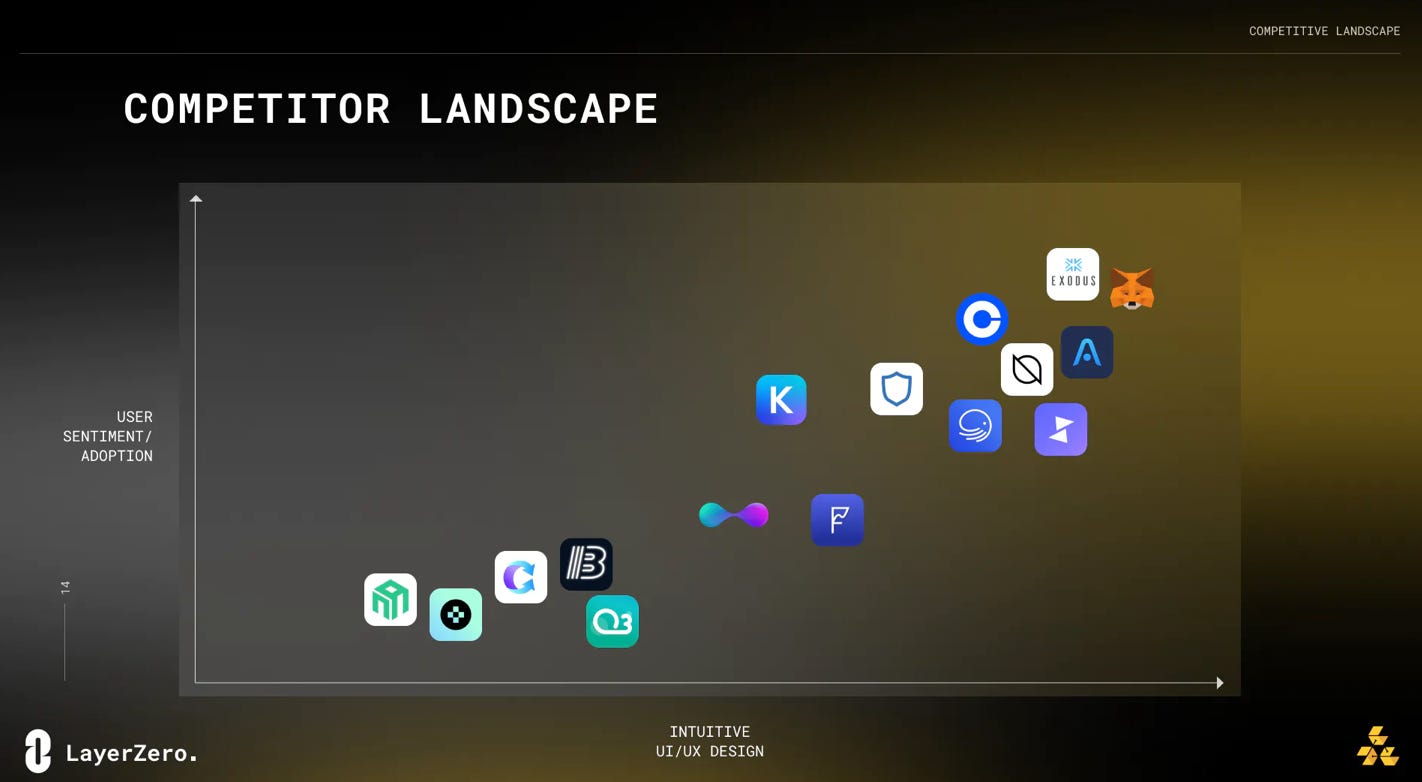

Cross-Chain Wallet Competitive Landscape: Market Research

As per the report, the cross-chain wallet space is dominated by a few large players that have established a positive brand image and user sentiment.

Here’s how the different cross-chain wallets compare based on the metric — user sentiment/adoption versus an intuitive, user-supported user interface design.

The team identified several features that were common across wallets and are important for a wallet’s mainstream adoption and ease of use:

Simple and intuitive UI design with abstracted swapping processes

In-app portfolio tracker

“Discover” tabs

Educational videos

A “favorited” list of tokens

Including tokens that the wallet provider has verified

Cross-Chain Wallet Competitive Landscape: Industry Interviews

The team conducted in-depth user interviews with 25 users leading to the following takeaways:

Some wallets lack user-friendly interfaces.

Users found it difficult to understand the nuances of the wallet experience like the status of the transaction, fee structure, etc.

Wallets can be complex to set up and use, especially for non-technical users.

Users found it difficult to navigate between different apps for swapping, storing, etc.

Building a Cross-Chain Wallet

The Blockchain at Berkeley team built a Proof of Concept of what a cross-chain wallet could look like. To do so, they forked MetaMask and implemented the described bridging and accessibility features based on their market research and user interviews. The features include:

Gas Fee Abstraction

Problem — Users must pay gas in native tokens and when the user doesn’t own the particular asset, they are required to use different services to first acquire the asset and then complete their transaction.

Solution — Enabling users to pay gas in any token that they already hold and thus eliminating the need for them to acquire native assets in order to complete transactions.

Note — This functionality is already being offered by wallets such as Obvious that enable users to create their own smart wallets and enable them to pay gas fees in any token using account abstraction.

Combined Bridging and Swapping

Problem — Most current implementation of bridging within wallets enables users to only bridge their assets as they separate the concepts of bridging and swapping into two types of actions.

For example, if a user wants to convert their ETH on Ethereum to MATIC on Polygon within MetaMask, they will first have to bridge ETH to Polygon using the bridging feature and then swap ETH for MATIC on Polygon using the swapping feature.

Solution — Combining the two concepts into one, enabling users to bridge and swap in a single transaction.

Note — This functionality is already live on several cross-chain wallets that have integrated bridge and DEX aggregators like LI.FI. Even within wallets like MetaMask that currently separate the two actions, such functionality will likely be offered soon as part of updates to the bridge feature and cross-chain flow.

Other UX Improvements

The team identified and improved upon several other UX problems such as:

Confusing wallet activity displays

Overwhelming transaction confirmation pages

Closing Thoughts

Blockchain at Berkeley's research on cross-chain wallets has identified significant user experience limitations in existing wallet offerings.

The identified limitations can be effectively resolved by incorporating concepts such as account abstraction and leveraging bridge and DEX aggregation technologies, along with messaging protocols (as demonstrated by the Proof of Concept wallet developed by the team).

It is worth noting that many wallet providers are already exploring ways to overcome these limitations. While current wallets may have constraints in facilitating seamless interactions with multiple blockchains, it is only a matter of time before they release updates that enhance the cross-chain user experience.

Simultaneously, it will be interesting to observe if new players emerge in the market, taking advantage of the cautious approach of established players and potentially gaining dominance by introducing innovative features in the interim.

Interesting Reads

1) Don’t Overload Ethereum’s Consensus

Get Started With LI.FI Today

For more information about the LI.FI protocol,

Head to our link portal at link3.to/lifi

Read our SDK’ quick start’ at docs.li.fi

Join the official Discord server

Follow our Telegram Newsletter

Subscribe on our Substack

or try our any-2-any swaps NOW at jumper.exchange