LI.Fuel Live on Jumper | Axelar Connects Cosmos <> EVM Chains | Linea Loyalty Program | Wormhole Connect & More!

Last Week In The Multi-Chain Ecosystem (01 - 07 May '23)

Welcome to LI.FI’s Cross Chain Insider newsletter. If you want to join this community of cross-chain aficionados learning about bridges, interoperability, and the multi-chain ecosystem, subscribe below.

You can also check out LI.FI’s research articles, and follow us on Twitter!

Bridge Updates

1) LI.FI Presents LI.Fuel Gas Feature on Jumper ⛽

LI.FI released the LI.Fuel gas feature, enabling users to get any amount of gas tokens on any chain. You can try LI.Fuel on Jumper.exchange.

2) Wormhole Connect: Integrate In-App Bridging in as Few as 3 Lines of Code 👏

Wormhole introduces Wormhole Connect with Drift Protocol as the launch partner. Wormhole Connect is an easy-to-integrate widget for dApps to add cross-chain bridging.

3) Across Support for USDT is Now Live 💪

Across announces support for USDT cross-chain transfers. Users can now bridge USDT with Across.

4) Axelar Connects Cosmos <> EVM Chains 🔗

Axelar announced that its General Message Passing (GMP) is now available between Cosmos and EVM chains. dApps can now “move any payload cross-chain – including function calls and other logic” between Cosmos and EVM chains.

5) Hyperlane Brings Interoperability to the Celestia Ecosystem 🤝

Hyperlane announced that it is working with Celestia to power its rollups with interoperability — With Hyperlane, developers can deploy a Celestia-secured rollup with out-of-the-box interoperability without having to rely on other third party bridges.

ChangeX, a non-custodial multi-chain crypto wallet, has integrated LI.FI’s SDK to power seamless cross-chain swaps directly inside the app. With the integration, users can bridge and swap their assets in a few clicks across networks supported by both ChangeX and LI.FI.

Multi-Chain Ecosystem Updates

1) Linea Loyalty Program on Galxe 🔥

Linea, a zkEVM Layer 2 built by ConsenSys, has partnered with Galxe to launch Linea Voyage, a loyalty program with quests for Linea’s public testnet. Featuring their Week 1 ecosystem partners including Connext, Multichain, LI.FI, Celer, & Hop Protocol–users can now explore dApps on Linea.

2) Sommelier Expands to Arbitrum w/ Axelar 🤝

Sommelier announced that it is going multi-chain via Axelar. Sommelier will use Axelar and its newly-minted Cosmos General Message Passing (GMP) technology to support vaults on Arbitrum One.

3) Cosmos Liquid Staking Module 🧐

The Cosmos community has approved the introduction of the Liquidity Staking Module (LSM) for future upgrades. This new module will allow users to liquid-stake their existing ATOM tokens, which are already staked.

4) Introducing the Chain-Agnostic Token (CAT) Standard 💪

Nexa Network introduces the Chain-Agnostic Token (CAT) standard, which allows tokens and NFTs to be natively present on multiple chains while remaining fungible across all chains. The transfer process is facilitated by the Nexa bridge, powered by Wormhole’s generic messaging.

5) Qredo introduces QSign: New Cross-Chain Crypto Primitive 🫡

QredoLabs has introduced QSign, which allows developers to generate blockchain addresses programmatically. They can also manage these addresses from their contract and create and broadcast signed transactions to move funds or interact with other contracts.

What’s Popping?

Why Bridge Aggregation

Hey there! So, last week was a pretty exciting time for your favorite duo, Kram and me or as Kram has dubbed us, ‘the trustless brothers’. We got invited to speak at the IEEE conference held in Dubai, where we talked about 'Bridge Aggregation in a Multi-Chain World' as part of the Cross-Chain track of the conference.

Now, this presentation was just a sneak peek into an upcoming article where we dive deeper into the bridge aggregation niche in crypto and expand on Pt1. The Evolution of Aggregation Theory.

Working with LI.FI, we often get asked, "why do we need a bridge aggregator?" Well, today we want to set the record straight and make the case for why bridge aggregation is so crucial in the rapidly evolving multi-chain ecosystem.

With the number of blockchains and liquidity across them continuing to grow, the need for seamless cross-chain transactions is becoming increasingly essential. And that's where bridge aggregators come in, connecting various liquidity sources and offering users and dApps a range of bridging options for cross-chain swaps.

Let's break down why bridge aggregation is so important and highlight its many benefits:

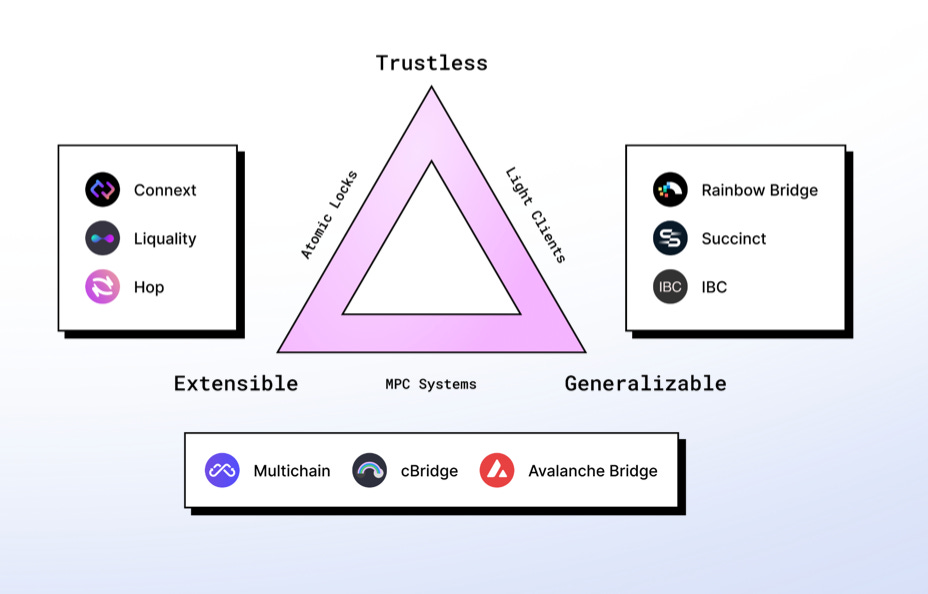

No bridge-type rules them all — No single bridge type is perfect for every use-case, as each has its own strengths and weaknesses based on the trade-offs made in the bridge design and architecture. Bridge aggregators recognize this diversity and incorporate multiple bridge types into their platform, ensuring that users and dApps can access the best possible bridging solution for their specific needs.

Failsafes are necessary in crypto — Crypto can be unpredictable and it's crucial to have backup options in case of technical issues or other unforeseen circumstances. Bridge aggregators provide these essential failsafes for users and dApps by offering multiple bridges and DEXs, ensuring that they can continue their cross-chain activities irrespective of any situation like bridge hacks, downtimes, etc.

Reduced fragmentation — Bridge aggregators integrate disparate liquidity sources into one platform or tech stack, streamlining the user and developer experiences.

Enhanced liquidity availability — An individual liquidity source may occasionally become depleted or face capacity constraints. This is quite common for token bridges that are essentially liquidity networks, which can struggle to match demand for bridgers when their pools become unbalanced. Bridge aggregators counteract this by routing liquidity from multiple sources, ensuring users can complete their transactions on time.

Reduced complexity and simplified user experience — By consolidating multiple bridge options into a single interface or tech stack (SDK, API), bridge aggregators significantly reduce the complexity associated with cross-chain transfers. Users can easily find the most suitable route for their swap based on unique requirements and preferences without navigating multiple platforms. Additionally, for dApps that want to add cross-chain functionality, bridge aggregators become a no-brainer solution as they offer all the bridges out of the box through their SDKs and APIs.

In conclusion, bridge aggregation is a necessary innovation for the evolving multi-chain landscape of crypto, and we believe they'll play a pivotal role in fostering connectivity across the ecosystem.

If you find this stuff interesting or have thoughts on aggregation and bridges, get a life make sure to read Pt.1 and reach out to me or Kram to be one of the beta readers of Pt.2.

Catch you later!

Interesting Reads

1) Across Technical Ingenuity Deep Dive: The Universal Bridge Adapter (UBA)

2) The Shared Sequencer; An SoK on Shared Sequencing, Aggregation Theory and Vertical Integrations

3) Summary of how Sovereign Rollups work

Get Started With LI.FI Today

For more information about the LI.FI protocol,

Head to our link portal at link3.to/lifi

Read our SDK’ quick start’ at docs.li.fi

Join the official Discord server

Follow our Telegram Newsletter

Subscribe on our Substack

or try our any-2-any swaps NOW at jumper.exchange

Okey sir thanks

Great