New Year, New Bridge Types: The State of Bridges in 2023

‘Everything is a bridge.’ ~ kram.eth (2023)

Bridges as we know them have evolved beyond traditional classifications. Today, we attempt to classify different types of bridges based on a very simplistic framework:

Any solution that can enable the movement of assets and/or data between chains can be thought of as a bridge.

This broad definition allows us to classify bridges based on their primary functions: tokens and data transfer.

Token Bridges: Transfer tokens between chains.

Data Bridges: Enable the movement of data or messages between chains.

Let's dive deeper into each category.

Classifying Different Solutions into Bridge Types

Tokens Bridges

Liquidity networks

A liquidity network is one which can facilitate the bridging and/or swapping of assets across chains.

There's a spectrum of these networks, each with its own advantages in terms of speed, cost, efficiency, security, and chain support.

Aggregators like LI.FI power front-ends such as Jumper.exchange to help users find the best route for their token swap across all these liquidity networks.

Let’s look at the different types of liquidity networks:

Pool based – liquidity providers deposit funds into pools on different chains which are used to exchange tokens. Most existing liquidity networks fall into this category.

Example: Across, Catalyst, Stargate, cBridge, Connext.

Orderflow auctions – these types of protocols optimize for two things: 1) UX and 2) best price for users. They do so by matching user’s orders with the best quote from Market Makers (typically decided via an auction).

Example: This design is more common in the same chain swaps domain where protocols like CoW Swap and 1inch Fusion are leading examples. In the cross-chain swaps domain, there’s currently deBridge’s DLN that has adopted this model while UniswapX will facilitate cross-chain swaps in the future using the same model.

Shared sequencers – not exactly liquidity networks themselves but combined with one, they can give shape to a powerful new cross-chain primitive.

For instance, Catalyst combined with a shared sequencer such as Espresso can enable atomic composability – Espresso being the sequencer can order transactions and guarantee atomic inclusion of cross-chain swaps whereas Catalyst being a liquidity network can execute them.

Burn and Mint

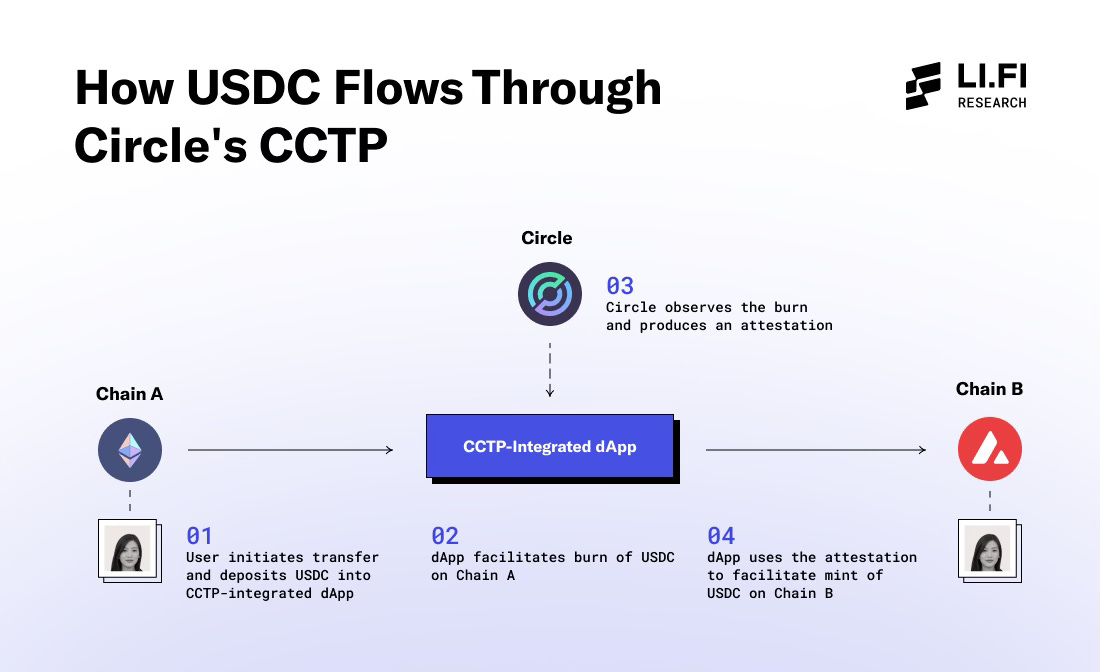

Stablecoin bridges – As the name suggests, stablecoin bridges facilitate the transfer of stablecoins across chains.

Specifically, stablecoin bridges move stablecoins from one chain to another via burn and mint mechanisms controlled by the stablecoin issuer.

Examples: Circle’s CCTP and Frax’s Ferry.

Omnichain token standards – these standards enable tokens to be burned and minted on any chain to power cross-chain swaps.

Instead of locking tokens on one chain and minting them on another. Almost every arbitrary messaging bridge has created a token standard.

Example: LayerZero’s OFTs, Wormhole xAssets, Axelar’s Interchain Token Service, and Connext’s bridge agnostic token standard xERC-20).

Lock and Mint

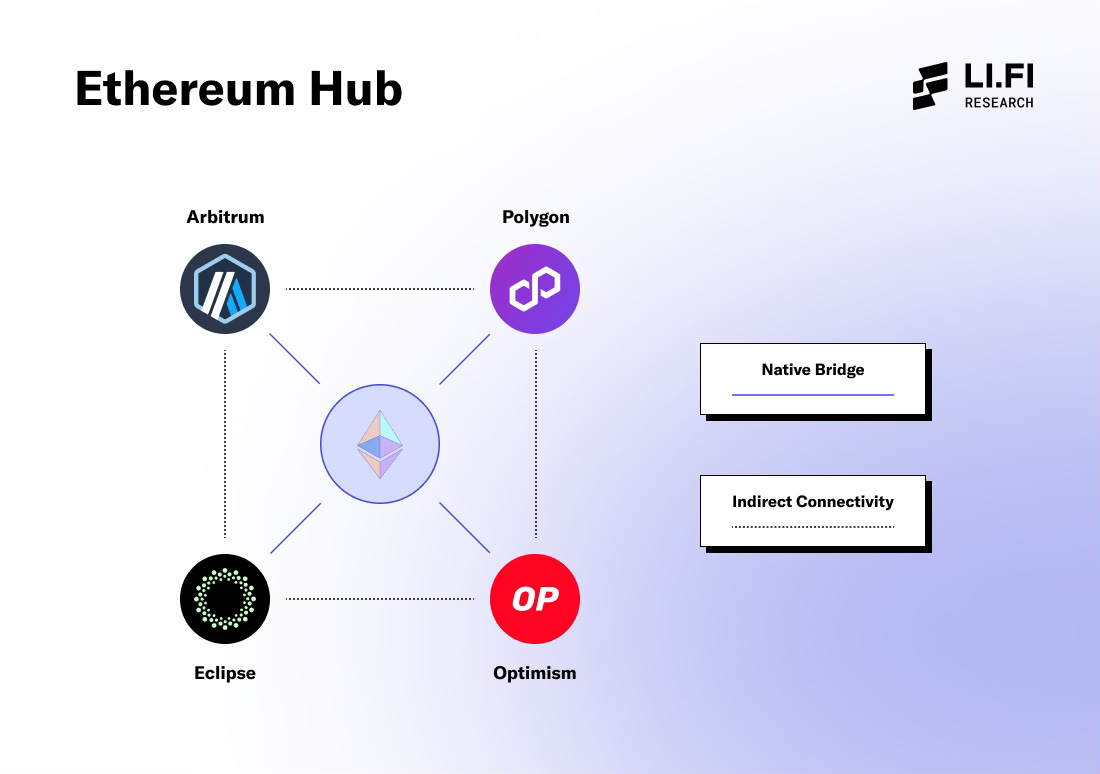

Native bridges – built between two blockchain ecosystems with the goal of bootstrapping liquidity on a particular blockchain. Most native bridges connect to Ethereum in order to make it easier for users to move liquidity from Ethereum to the specific blockchain.

These bridges lock assets on one chain and mint the asset on the other. Typically, assets minted via the native bridges are considered the canonical asset of choice on a chain by social consensus.

Token specific bridges – these bridges are used to create wrapped versions of tokens on different chains. They lock assets on one chain and mint them on another.

Example: BitGo and wBTC, bringing Bitcoin to Ethereum or the Aptos Bridge, powered by LayerZero.

Data Bridges

Arbitrary Messaging Bridges

There is a whole ecosystem of platforms that we at LI.FI call “arbitrary messaging bridges” (AMBs) working to expand the scope of cross-chain communication.

As the name suggests, these bridges allow for any piece of data, including tokens, the state of a chain, a contract call, an NFT, or governance votes, to be moved from chain A to chain B.

Native bridges – built to connect two blockchain ecosystems with the goal of establishing trust-minimized messaging between the two chains.

These bridges are currently considered to be the most secure way of sending data between two chains as typically the validators of the blockchains verify bridging transactions as well and also due to the bridge’s integral role in the blockchain ecosystems it’s connecting.

Example: Rollups and their native bridge with Ethereum.

Third party bridges – native bridges are typically built to establish connectivity between a blockchain and Ethereum. However, there’s a need to connect different blockchains with each other as well and that’s where messaging bridges built by different protocols come into play.

Examples: LayerZero, Wormhole, Axelar, Hyperlane, and other messaging bridges.

As we expand into a multi-rollup, modular ecosystem, the role of these types of messaging bridges will only expand as the fragmentation across different chains increases.

Beyond this point, we’ll be looking at different concepts that aren’t really classified as bridges but can play the role of bridges to enable cross-chain interoperability.

Storage Proofs

Storage proofs verify the state of one chain on another without transmitting messages between them. They offer a new approach to interoperability and have the potential of replacing or improving the efficiency of messaging bridges in the future.

Examples: Axiom, Lagrange, and Herodotus are working on storage proofs, especially in ecosystems like Starknet.

Proof Aggregation

Protocols working in this area focus on bundling multiple cryptographic proofs together, forming a single compact proof that requires less amount of resources for verification. As a result, these protocols can be used to validate cross-chain transactions with lesser complexity and resources.

In the future, existing messaging bridges could potentially leverage proof aggregation to enable interoperability across blockchains that use proofs for verification.

This is still in very early stages of development and I believe projects like Succinct Labs are working in this area.

Shared sequencers

Having a shared resource responsible for ordering transactions of a set of rollups can significantly improve the efficiency of cross-rollup interoperability solutions.

Shared sequencers can strategically order, reorder, and include transactions within batches and messaging bridges can leverage this to offer faster and guaranteed finality of messages and transactions.

That’s it for today. As you might be able to tell, I love bridges and might be seeing everything through my bridge-maxi lens while writing this.

I’m excited to see how these primitives develop in the future!

Get Started With LI.FI Today

For more information about the LI.FI protocol,

Head to our link portal at link3.to/lifi

Read our SDK’ quick start’ at docs.li.fi

Join the official Discord server

Follow our Telegram Newsletter

Subscribe on our Substack

or try our any-2-any swaps NOW at jumper.exchange